By Ivan Kwok | 27 January 2026 | 0 Comments

Why Is It Difficult for Chinese Steadicam Brands to Enter the International High‑End Film/Video Prod

What are the core Steadicam brands currently in China?

Based on the criterion of “equipment actually used for professional work and available for purchase/rental in China,” the market can be roughly divided into three tiers:

A. International Tier One Brands

(Common in high end domestic sets/rental houses)

Tiffen / Steadicam – The industry standard system.

ARRI Stabilizer Systems (TRINITY/ARTEMIS, etc.) – High end hybrid/mechanical systems.

PRO / XCS / Klassen / GPI PRO, etc. – Primarily circulate within international rental networks and professional operator circles.

For this tier, the “product” is only one component; what supports it includes: training systems, union/professional operator reputation, rental networks, and long term reliability records.

B. Domestic/Localized Brands

Discussed and purchased for professional use within China’s industry:

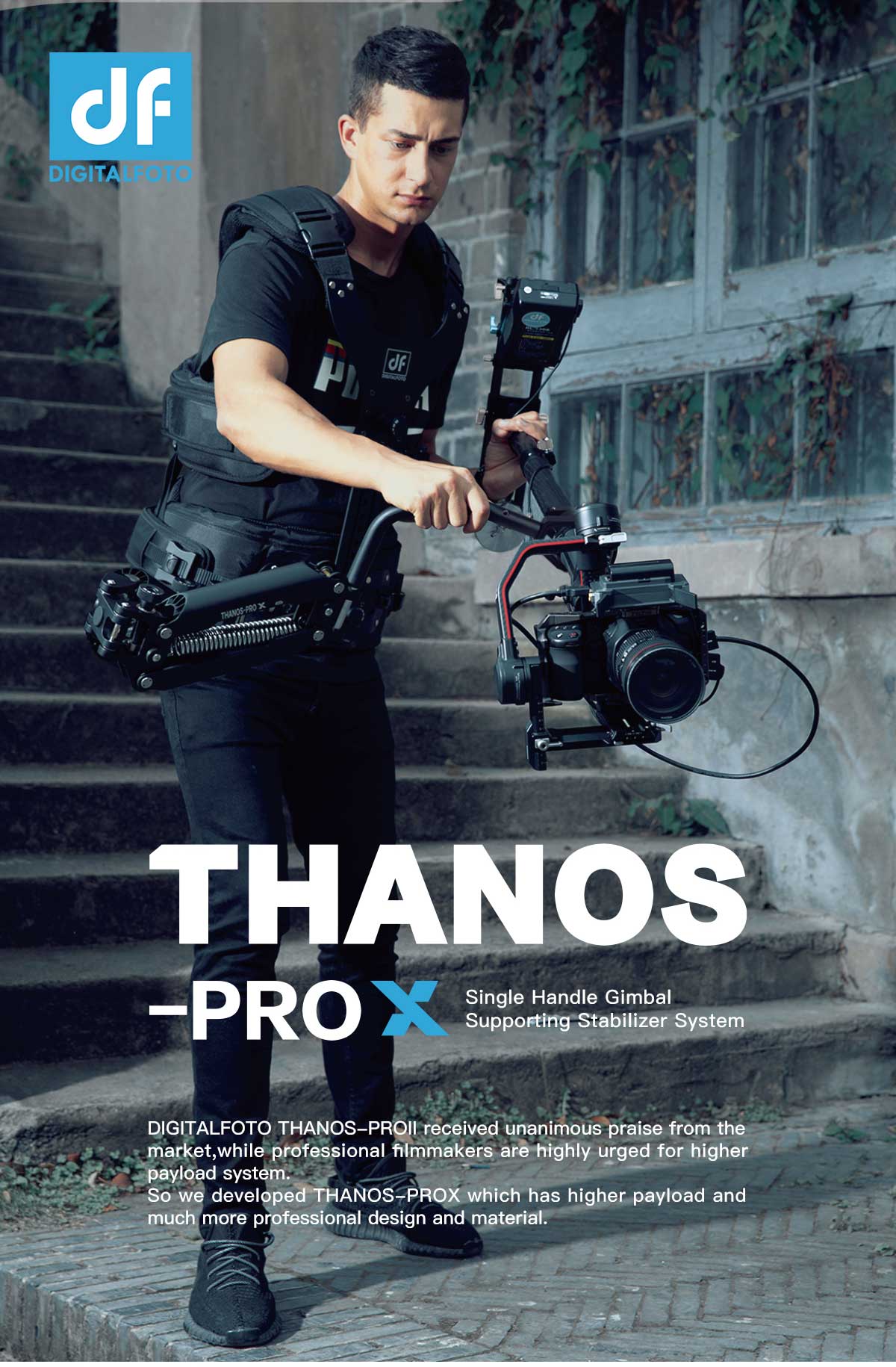

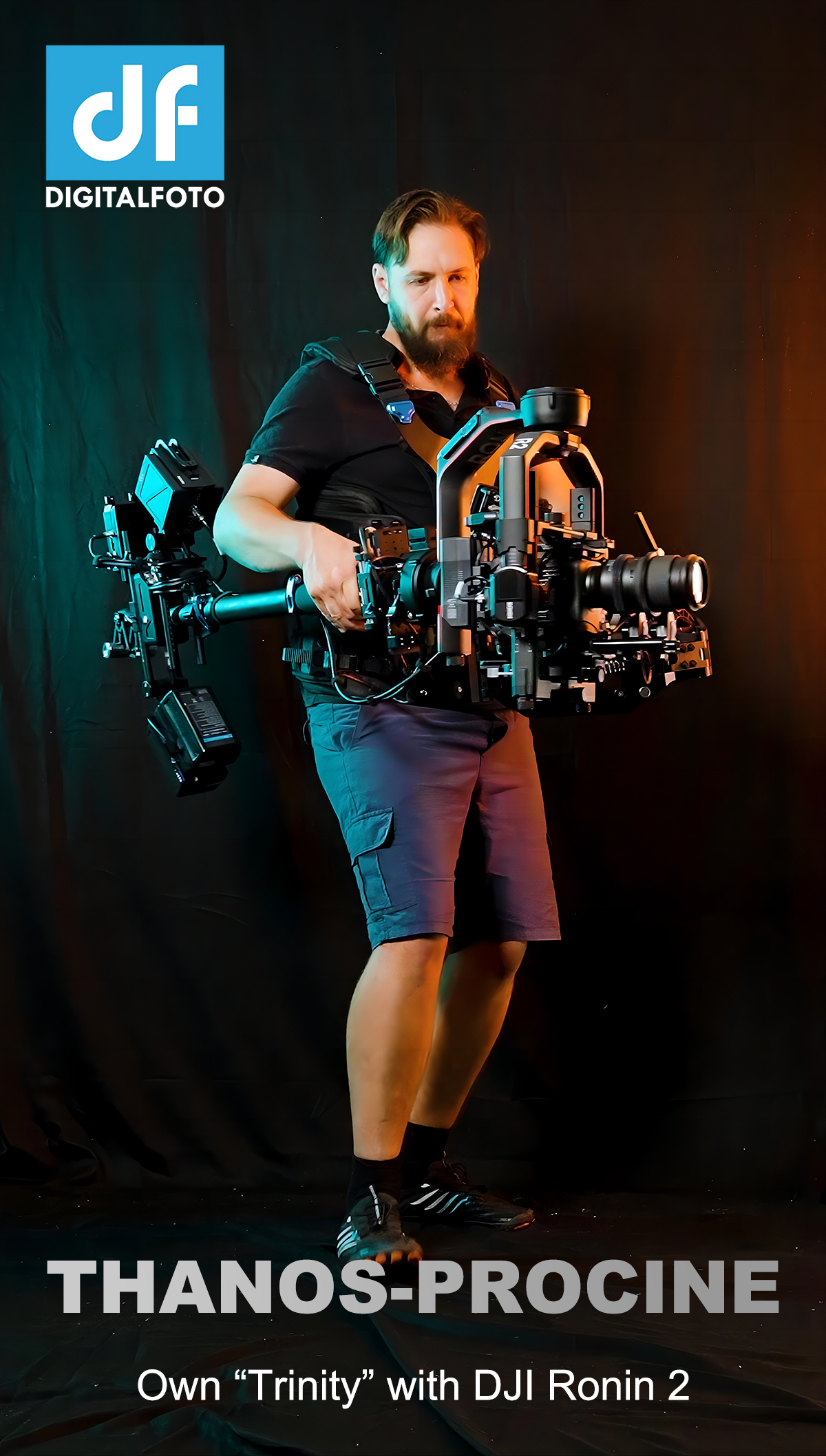

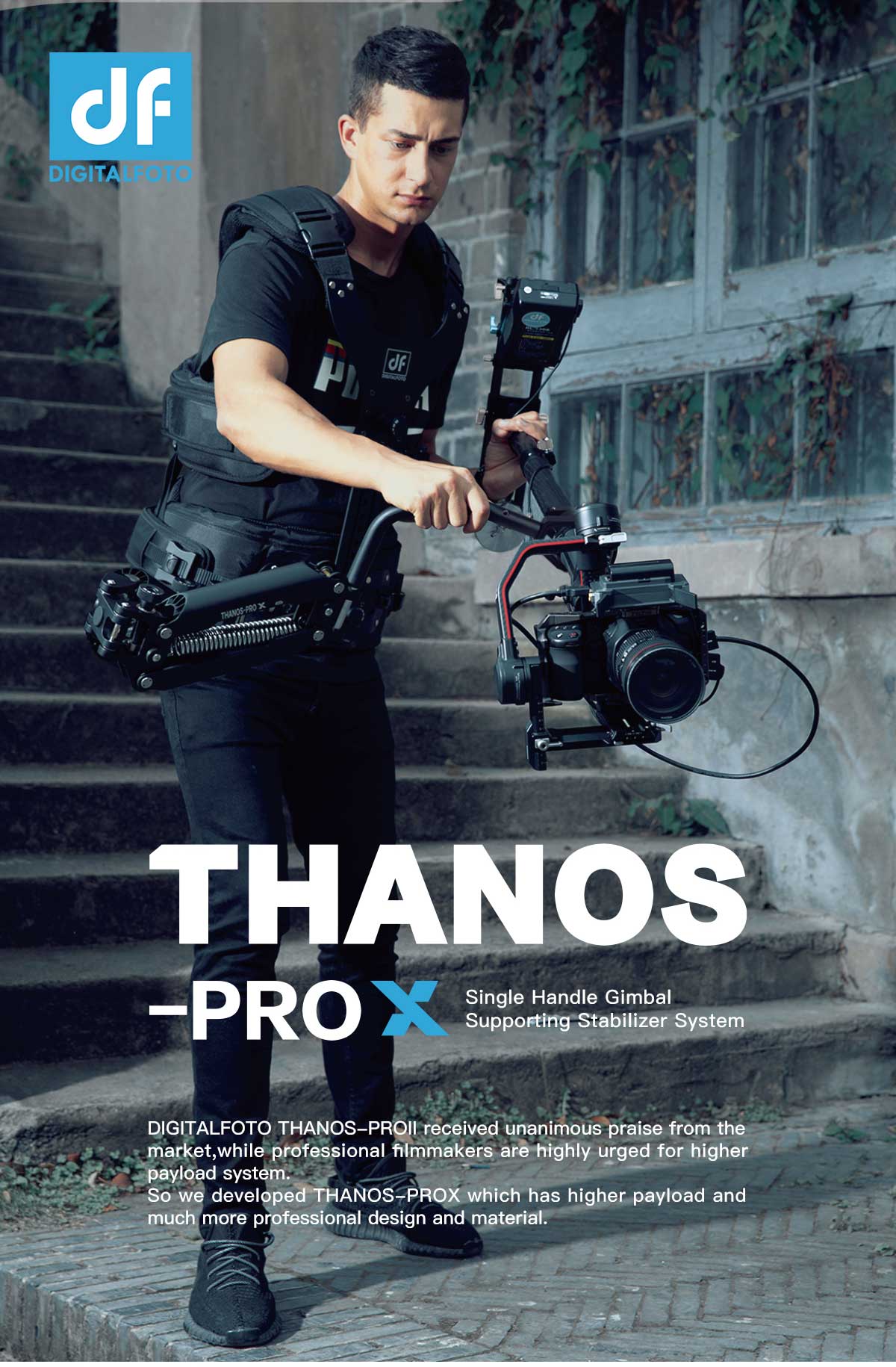

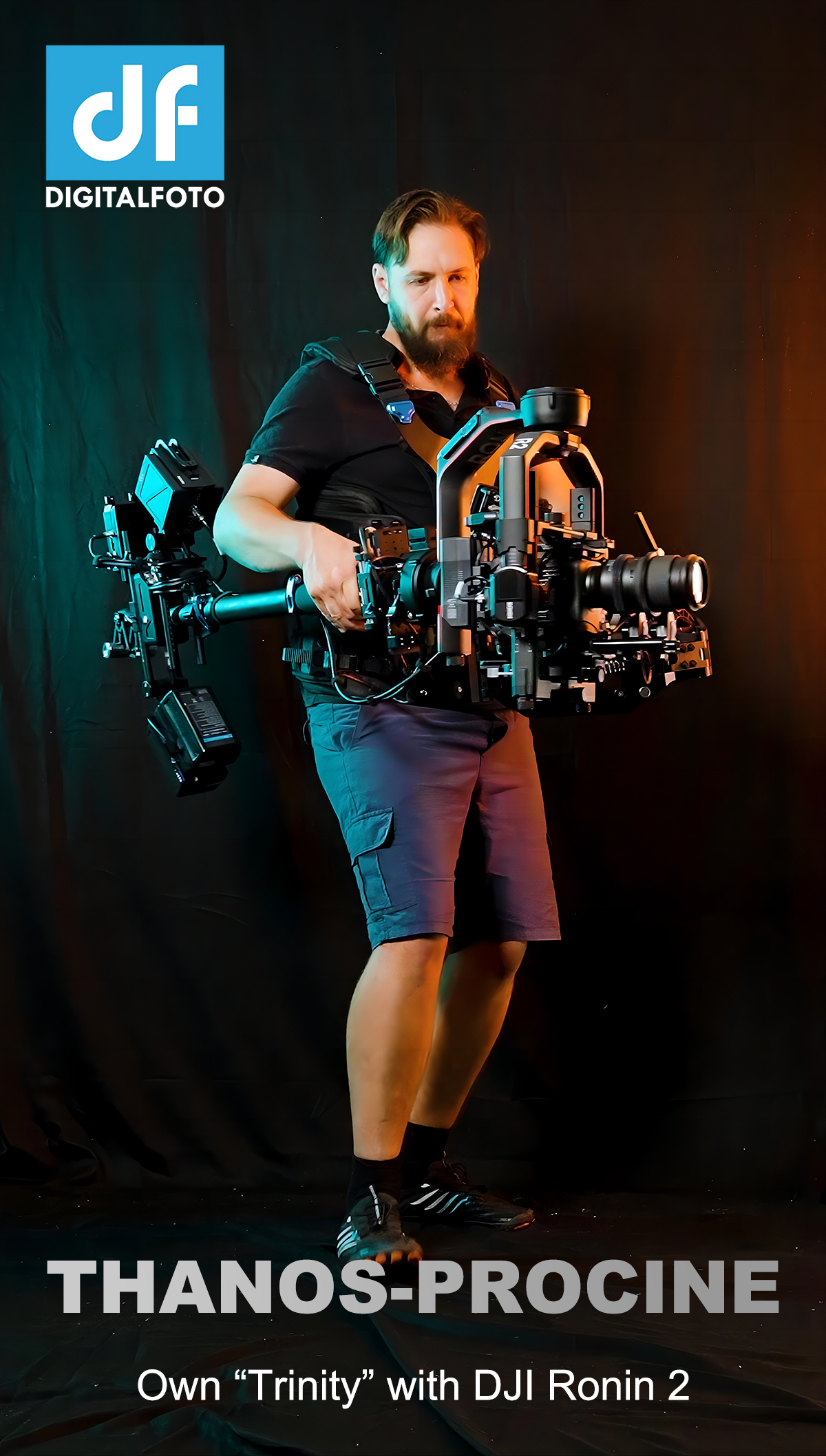

DIGITALFOTO (THANOS series, THANOS PROCINE, etc.)

MOVCAM, etc. – Brands actually used by domestic operators.

A small number of workshop type/semi custom teams – Enjoy reputation in specific circles but have limited scale and international influence.

C. Mass Market/Entry Level Brands

(More oriented toward “beginner experience/light load/low price”)

Many “camera accessory brands/OEM labels” also sell so called “steadicam/vest/arm” products, but most are entry level gear rather than equipment on professional sets.

Why Can’t Chinese Steadicam Brands Command High Prices in the International Market?

High prices are not merely “cost + profit” but a “credibility premium.” Chinese brands generally face six barriers in the high end international segment:

1. Incomplete Trust Chain Within Professional Circles

High end operators trust: long term reputation, repeated verification in rental environments, and traceable version evolution with failure rate records. New brands struggle to build this chain.

2. Insufficient Consistency and Reproducibility (Most Critical)

High end users care less about “maximum load capacity” and more about consistency. Any “unit to unit variation” drives market prices down.

3. Core Experience Barriers Such as “Iso Elasticity / Spring Curve”

In traditional Steadicam systems, the vest + iso elastic arm is a key experiential differentiator.

If the same level of spring curve consistency and durability stability is not achieved, high end pricing will naturally be questioned.

In the traditional Steadicam system, the vest + iso elastic arm is one of the key sources of its signature user experience. Steadicam is a camera stabilization brand for motion picture filming, invented by Garrett Brown and first launched in 1975 by Cinema Products Corporation.

Its design mechanically isolates the camera from the operator’s movement, achieving smooth and fluid motion shots. The brand was acquired by Tiffen in 2000.

Development History Before Steadicam, moving shots were primarily achieved through:

- Dolly: Movement on tracks or smooth surfaces.

- Camera Crane: Vertical and horizontal movement.

- Handheld: Often used for documentary content or scenes pursuing an immediate, authentic feel. In 1975, Garrett Brown developed the first prototype—the “Brown Stabilizer”—and created a demo film to show directors such as Stanley Kubrick.

Production was later licensed to Cinema Products Corporation, gradually expanding into the consumer market. Milestone Films

- 1976 Bound for Glory – First feature film use, transitioning from crane to handheld movement.

- 1976 Rocky – Iconic running scenes and boxing ring tracking shots.

- 1976 Marathon Man – Chase sequences through New York streets.

- 1980 The Shining – Pioneered “low mode” for ground level perspectives.

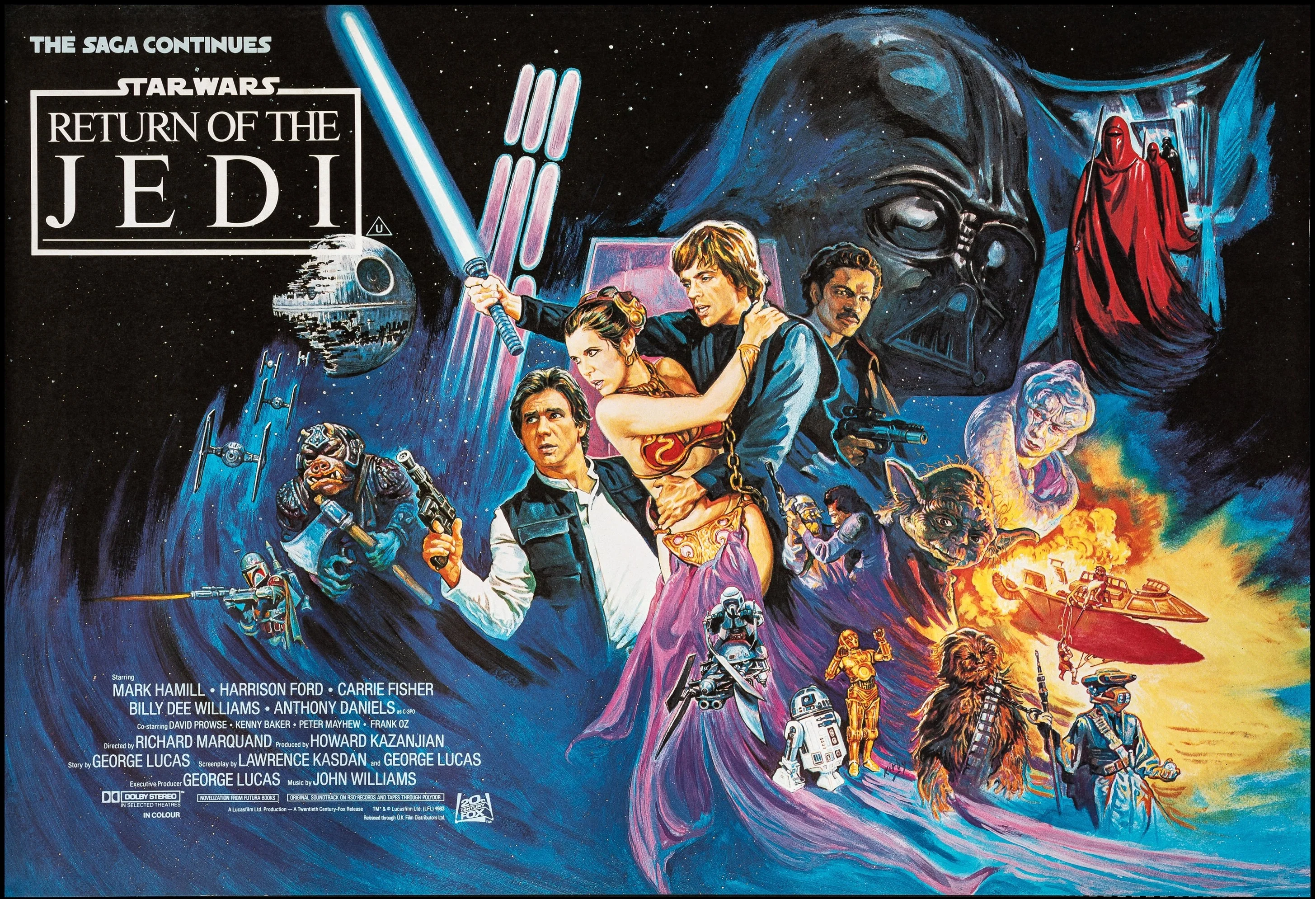

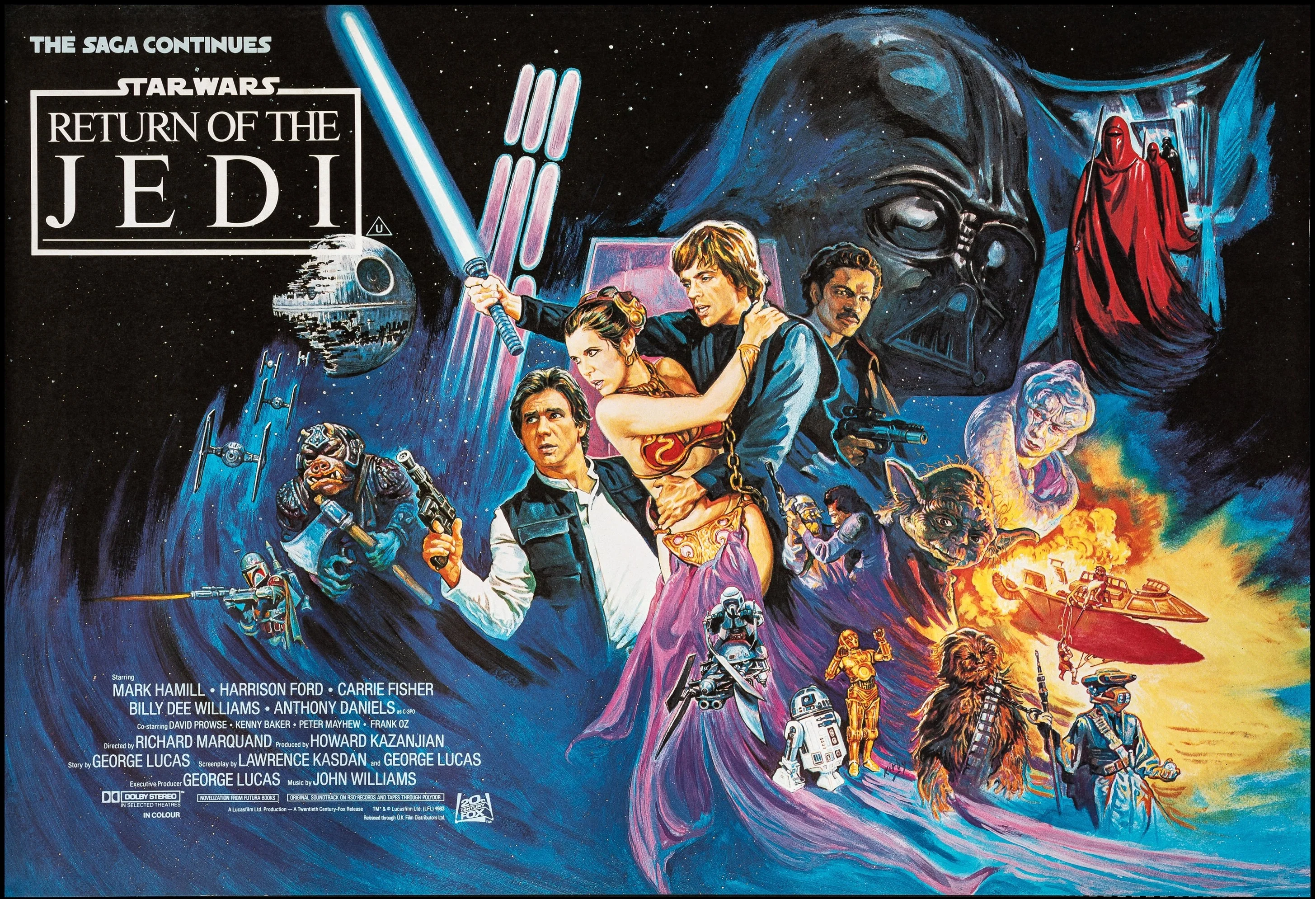

- 1983 Star Wars: Episode VI – Return of the Jedi – Integrated gyroscopes to create high speed flight illusions.

- 1984 Runaway – Simulated a smart bullet’s subjective perspective.

System Components & Principle

- Vest: Distributes weight to the operator’s torso.

- Arm: Absorbs walking and movement shocks.

- Gimbal: Enables low friction multi axis movement.

-Sled: Holds the camera at the top and a monitor/battery at the bottom, using counterbalance for stability. Operational Features

- Can be balanced to stay upright when released.

- Low mode inverts the sled to lower shooting height.

- Modern models like the Tango allow quick high/low angle switching, Merlin suits small cameras, and Smoothee targets smartphone filming. Technological Evolution

- 1970s: Foundational cinema grade systems.

- 1990s: Lighter models and DV compatible versions.

- 2000s: Digital integration and wireless control.

- 2010s: Expansion into consumer markets (e.g., smartphone stabilizers). Awards & Recognition

- 1978: Academy Honorary Award (Garrett Brown & engineering team).

- 1992: Camera Operators Society Technical Achievement Award.

- 2001: American Society of Cinematographers President’s Award.

- 2012: Steadicam Guild Life Achievement Award (Garrett Brown).

- 2014: Satellite Awards Nikola Tesla Award. Industry Impact Steadicam revolutionized the paradigm of moving shots, freeing camera movement from tracks and terrain limitations.

It is widely used in film, documentary, and even news production. Its “mechanical isolation” principle also inspired later electronic stabilization technologies, and it remains an irreplaceable professional tool in the film industry. Classic Reference Clips - Bound for Glory – Steadicam shot from crane to ground. - Rocky – Tracking up the Philadelphia Museum of Art steps. - The Shining – Low angle hallway follow shot. Note: If a stabilizer cannot match the same level of spring curve consistency and long term durability, its premium pricing will naturally be questioned.

4. “Hidden Costs” of Interface/Standard/Ecosystem Compatibility

Sets are reluctant to rebuild around a system: socket block adjustment standards, accessory specifications, repair parts, consumables, etc. If compatibility is not “default ready,” high prices are hard to justify.

5. Inadequate After Sales/Spare Parts/Service Network

High price = risk transferred to the brand. If you cannot provide predictable repair cycles and spare parts in regions like Europe and North America, clients won’t pay a “peace of mind premium.”

6. Lack of Brand Narrative and Compliance Endorsement

Sets involve insurance, liability, and compliance (especially in rental). Without proper endorsements, prices are pressured downward.

Why Is It Difficult for Chinese Steadicam Brands to Enter the International High End Film/Video Production Market?

The essence is that “the buyer is not an individual consumer, but a system.”

High end set purchasing logic involves rental houses, equipment supervisors, and professional operators deciding together.

Even if a product has “great specs and a better price,” it is often dismissed with: “We don’t want to be the first to beta test on a major project.”

Will Equipment Lightweighting and the Short Video Era Continue to Erode the Steadicam Market?

Yes, but not completely replace it. Reasons can be explained through “ground level physics”:

Areas That Will Continue to Be Eroded:

Light commercial content (short videos, events, corporate films, fast turnaround projects).

Solo operators: 3 axis gimbals have lower learning curves, higher efficiency, and “looking stable” is increasingly easier (thanks to algorithms and sensors).

Systems like the DJI Ronin series and Ronin 4D, which integrate stabilization/control, will continue to squeeze part of the traditional market.

Areas That Remain Difficult to Replace:

The “feel” and spatial float of long takes (the perceptual difference of mechanical isolation).

Isolation of Z axis gait movement: 3 axis gimbals can correct tilt, but “vertical bounce from walking” is hard to eliminate completely.

Ergonomics for heavy load/long duration work: many large setups still require support systems (Easyrig/ReadyRig, etc.), showing that “weight relief” hasn’t disappeared—only changed form.

Conclusion: Short video equipment will capture the “entry and mid level delivery” market, but Steadicam will remain concentrated in professional scenarios that demand “specific cinematic feel, long takes, professional operators, heavy loads, and extended runtime.”

Future Market Positioning, Pricing, and User Group Strategy for Steadicam

Building on ’s existing strengths (cost performance, rapid iteration, user co creation, product line extension from THANOS SE to PROCINE), a more rational approach would be:

Pricing Positioning – Two Tiers Are Healthier:

1. Creator/Prosumer Line: Affordable and reliable for “first time vest and arm users.”

2. Pro/Cine Line: Emphasize reliability, consistency, standard compatibility, and long term comfort—not just “cheaper.”

High end isn’t about “expensive,” but about “daring to promise: every unit performs identically well.”

User Group Positioning – Speak Differently to Three Audiences:

1. 3 axis gimbal users upgrading: Pain points = fatigue, expandability, vertical shake.

2. Traditional Steadicam operators: Pain points = spring curve consistency, feel, standard compatibility, maintainability.

3. Budget conscious film level teams: Pain points = “cinematic look” + “able to deliver” on a limited budget.

Key Initiatives Is Driving to Enter the International High End Market

1. Consistency Engineering: Factory torque tolerances, damping/spring curve consistency, lifespan decay curves.

2. Standard Compatibility Transparency: Aligning socket block adjustment modules, interfaces, and accessory specifications with mainstream systems.

3. International After Sales and Spare Parts: Establishing predictable spare parts and repair pathways at least in North America/Europe.

4. Endorsement by Professional Operators: Not just “reviews,” but long term usage reports from operators on real projects.

Based on the criterion of “equipment actually used for professional work and available for purchase/rental in China,” the market can be roughly divided into three tiers:

A. International Tier One Brands

(Common in high end domestic sets/rental houses)

Tiffen / Steadicam – The industry standard system.

ARRI Stabilizer Systems (TRINITY/ARTEMIS, etc.) – High end hybrid/mechanical systems.

PRO / XCS / Klassen / GPI PRO, etc. – Primarily circulate within international rental networks and professional operator circles.

For this tier, the “product” is only one component; what supports it includes: training systems, union/professional operator reputation, rental networks, and long term reliability records.

B. Domestic/Localized Brands

Discussed and purchased for professional use within China’s industry:

DIGITALFOTO (THANOS series, THANOS PROCINE, etc.)

MOVCAM, etc. – Brands actually used by domestic operators.

A small number of workshop type/semi custom teams – Enjoy reputation in specific circles but have limited scale and international influence.

C. Mass Market/Entry Level Brands

(More oriented toward “beginner experience/light load/low price”)

Many “camera accessory brands/OEM labels” also sell so called “steadicam/vest/arm” products, but most are entry level gear rather than equipment on professional sets.

Why Can’t Chinese Steadicam Brands Command High Prices in the International Market?

High prices are not merely “cost + profit” but a “credibility premium.” Chinese brands generally face six barriers in the high end international segment:

1. Incomplete Trust Chain Within Professional Circles

High end operators trust: long term reputation, repeated verification in rental environments, and traceable version evolution with failure rate records. New brands struggle to build this chain.

2. Insufficient Consistency and Reproducibility (Most Critical)

High end users care less about “maximum load capacity” and more about consistency. Any “unit to unit variation” drives market prices down.

3. Core Experience Barriers Such as “Iso Elasticity / Spring Curve”

In traditional Steadicam systems, the vest + iso elastic arm is a key experiential differentiator.

If the same level of spring curve consistency and durability stability is not achieved, high end pricing will naturally be questioned.

In the traditional Steadicam system, the vest + iso elastic arm is one of the key sources of its signature user experience. Steadicam is a camera stabilization brand for motion picture filming, invented by Garrett Brown and first launched in 1975 by Cinema Products Corporation.

Its design mechanically isolates the camera from the operator’s movement, achieving smooth and fluid motion shots. The brand was acquired by Tiffen in 2000.

Development History Before Steadicam, moving shots were primarily achieved through:

- Dolly: Movement on tracks or smooth surfaces.

- Camera Crane: Vertical and horizontal movement.

- Handheld: Often used for documentary content or scenes pursuing an immediate, authentic feel. In 1975, Garrett Brown developed the first prototype—the “Brown Stabilizer”—and created a demo film to show directors such as Stanley Kubrick.

Production was later licensed to Cinema Products Corporation, gradually expanding into the consumer market. Milestone Films

- 1976 Bound for Glory – First feature film use, transitioning from crane to handheld movement.

- 1976 Rocky – Iconic running scenes and boxing ring tracking shots.

- 1976 Marathon Man – Chase sequences through New York streets.

- 1980 The Shining – Pioneered “low mode” for ground level perspectives.

- 1983 Star Wars: Episode VI – Return of the Jedi – Integrated gyroscopes to create high speed flight illusions.

- 1984 Runaway – Simulated a smart bullet’s subjective perspective.

System Components & Principle

- Vest: Distributes weight to the operator’s torso.

- Arm: Absorbs walking and movement shocks.

- Gimbal: Enables low friction multi axis movement.

-Sled: Holds the camera at the top and a monitor/battery at the bottom, using counterbalance for stability. Operational Features

- Can be balanced to stay upright when released.

- Low mode inverts the sled to lower shooting height.

- Modern models like the Tango allow quick high/low angle switching, Merlin suits small cameras, and Smoothee targets smartphone filming. Technological Evolution

- 1970s: Foundational cinema grade systems.

- 1990s: Lighter models and DV compatible versions.

- 2000s: Digital integration and wireless control.

- 2010s: Expansion into consumer markets (e.g., smartphone stabilizers). Awards & Recognition

- 1978: Academy Honorary Award (Garrett Brown & engineering team).

- 1992: Camera Operators Society Technical Achievement Award.

- 2001: American Society of Cinematographers President’s Award.

- 2012: Steadicam Guild Life Achievement Award (Garrett Brown).

- 2014: Satellite Awards Nikola Tesla Award. Industry Impact Steadicam revolutionized the paradigm of moving shots, freeing camera movement from tracks and terrain limitations.

It is widely used in film, documentary, and even news production. Its “mechanical isolation” principle also inspired later electronic stabilization technologies, and it remains an irreplaceable professional tool in the film industry. Classic Reference Clips - Bound for Glory – Steadicam shot from crane to ground. - Rocky – Tracking up the Philadelphia Museum of Art steps. - The Shining – Low angle hallway follow shot. Note: If a stabilizer cannot match the same level of spring curve consistency and long term durability, its premium pricing will naturally be questioned.

4. “Hidden Costs” of Interface/Standard/Ecosystem Compatibility

Sets are reluctant to rebuild around a system: socket block adjustment standards, accessory specifications, repair parts, consumables, etc. If compatibility is not “default ready,” high prices are hard to justify.

5. Inadequate After Sales/Spare Parts/Service Network

High price = risk transferred to the brand. If you cannot provide predictable repair cycles and spare parts in regions like Europe and North America, clients won’t pay a “peace of mind premium.”

6. Lack of Brand Narrative and Compliance Endorsement

Sets involve insurance, liability, and compliance (especially in rental). Without proper endorsements, prices are pressured downward.

Why Is It Difficult for Chinese Steadicam Brands to Enter the International High End Film/Video Production Market?

The essence is that “the buyer is not an individual consumer, but a system.”

High end set purchasing logic involves rental houses, equipment supervisors, and professional operators deciding together.

Even if a product has “great specs and a better price,” it is often dismissed with: “We don’t want to be the first to beta test on a major project.”

Will Equipment Lightweighting and the Short Video Era Continue to Erode the Steadicam Market?

Yes, but not completely replace it. Reasons can be explained through “ground level physics”:

Areas That Will Continue to Be Eroded:

Light commercial content (short videos, events, corporate films, fast turnaround projects).

Solo operators: 3 axis gimbals have lower learning curves, higher efficiency, and “looking stable” is increasingly easier (thanks to algorithms and sensors).

Systems like the DJI Ronin series and Ronin 4D, which integrate stabilization/control, will continue to squeeze part of the traditional market.

Areas That Remain Difficult to Replace:

The “feel” and spatial float of long takes (the perceptual difference of mechanical isolation).

Isolation of Z axis gait movement: 3 axis gimbals can correct tilt, but “vertical bounce from walking” is hard to eliminate completely.

Ergonomics for heavy load/long duration work: many large setups still require support systems (Easyrig/ReadyRig, etc.), showing that “weight relief” hasn’t disappeared—only changed form.

Conclusion: Short video equipment will capture the “entry and mid level delivery” market, but Steadicam will remain concentrated in professional scenarios that demand “specific cinematic feel, long takes, professional operators, heavy loads, and extended runtime.”

Future Market Positioning, Pricing, and User Group Strategy for Steadicam

Building on ’s existing strengths (cost performance, rapid iteration, user co creation, product line extension from THANOS SE to PROCINE), a more rational approach would be:

Pricing Positioning – Two Tiers Are Healthier:

1. Creator/Prosumer Line: Affordable and reliable for “first time vest and arm users.”

2. Pro/Cine Line: Emphasize reliability, consistency, standard compatibility, and long term comfort—not just “cheaper.”

High end isn’t about “expensive,” but about “daring to promise: every unit performs identically well.”

User Group Positioning – Speak Differently to Three Audiences:

1. 3 axis gimbal users upgrading: Pain points = fatigue, expandability, vertical shake.

2. Traditional Steadicam operators: Pain points = spring curve consistency, feel, standard compatibility, maintainability.

3. Budget conscious film level teams: Pain points = “cinematic look” + “able to deliver” on a limited budget.

Key Initiatives Is Driving to Enter the International High End Market

1. Consistency Engineering: Factory torque tolerances, damping/spring curve consistency, lifespan decay curves.

2. Standard Compatibility Transparency: Aligning socket block adjustment modules, interfaces, and accessory specifications with mainstream systems.

3. International After Sales and Spare Parts: Establishing predictable spare parts and repair pathways at least in North America/Europe.

4. Endorsement by Professional Operators: Not just “reviews,” but long term usage reports from operators on real projects.

Leave a Reply

Your email address will not be published.Required fields are marked. *

POPULAR BLOG

- Master Your Craft: A Two-Day Workshop on Pro Stabilizers & Creative Lighting

- DF DigitalFoto at BIRTV 2025: A Spotlight on Innovation and Creativity

- DigitalFoto Shines at PHOTOGRAPHER'S BAZAAR8 in Kuwait

- DF DIGITALFOTO Christmas Promotion

- DH04 PRO, DH04-RS2, ARES Three 4th Z Axis Detachable Spring Dual Handles, which one do you prefer?

CATEGORIES